Managing your finances can be a daunting task, but with the right tools and strategies, you can transform your financial routine into a streamlined, stress-free process. Our planner insert is designed to help you take control of your budgeting, savings, and bill payments effortlessly. Let’s dive into how our insert can become your financial ally, explore tips and tricks for effective money management, and uncover marketing strategies to share this essential tool with others.

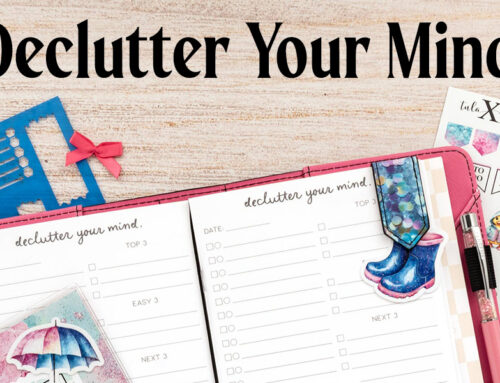

How Our Planner Insert Works

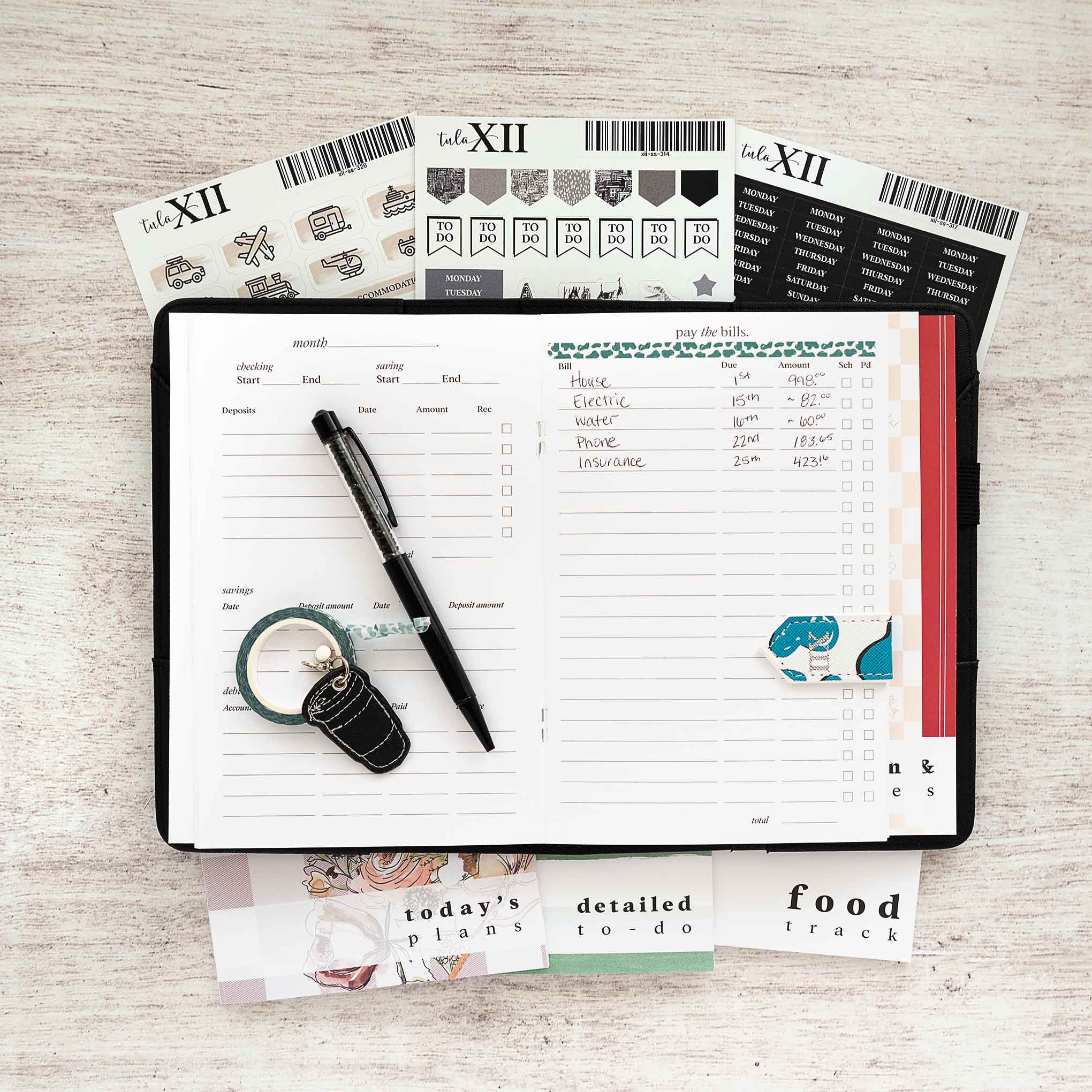

Our budgeting and bill pay planner insert is crafted to simplify your financial tracking:

- Left Side: Income, Savings, and Debt Tracking

This section helps you keep a clear overview of your financial landscape. You can record your monthly income, track savings goals, and manage debt repayments. This holistic view aids in better financial planning and decision-making. - Right Side: Bill Payment Tracking

The right side is dedicated to listing out your monthly bills and tracking payments. With checkboxes to mark off bills as paid, this section helps you stay organized and avoid missing payments.

Tips and Tricks for Effective Budgeting and Bill Paying

- Track Your Income Regularly

Begin by listing all sources of income. Update this regularly to reflect any changes, such as bonuses or side gigs. Understanding your total income helps you plan more accurately and avoid overspending. - Set Realistic Savings Goals

Allocate a portion of your income to savings. Set clear, achievable goals—whether it’s for an emergency fund, a vacation, or a large purchase. Regularly review and adjust these goals as needed to stay on track. - Prioritize Debt Repayments

List all your debts, including credit cards, loans, and any other liabilities. Focus on paying off high-interest debts first while making minimum payments on others. Our insert lets you track your progress and stay motivated. - Create a Monthly Budget

Develop a detailed budget by categorizing your expenses—housing, utilities, groceries, transportation, etc. Compare this with your income to ensure you’re living within your means. Adjust your spending or savings plan as necessary. - Automate Savings and Bill Payments

Set up automatic transfers to your savings account and automate bill payments when possible. This reduces the risk of late payments and helps you build savings consistently. - Review and Adjust Regularly

At the end of each month, review your spending and savings. Adjust your budget and financial goals based on your review to accommodate any changes in income or expenses. - Use a Financial Calendar

Keep a financial calendar to track due dates for bills and payment reminders. Our planner insert makes it easy to see which bills are coming up and when they’ve been paid. - Keep Track of Subscriptions

Regularly review and update your list of subscriptions and recurring payments. Cancel any services you no longer use to avoid unnecessary expenses. - Plan for Irregular Expenses

Allocate a portion of your budget for irregular expenses like car maintenance or annual insurance premiums. This prevents surprises and helps you manage your finances more effectively. - Engage with Financial Goals

Set up visual reminders for your savings goals and debt repayments. Celebrate milestones to keep yourself motivated and on track.